- City Departments

-

-

Community Development

-

Community Response

-

Convention and Cultural Services

-

Finance

-

Fire Department

-

Human Resources

-

Information Technology

-

Mayor and Council

-

Office of Public Safety Accountability

-

Office of the City Attorney

-

Office of the City Auditor

-

Office of the City Clerk

-

Office of the City Manager

-

Office of the City Treasurer

-

Police Department

-

Public Works

-

Utilities

-

Youth, Parks, & Community Enrichment

-

- Browse by categories

-

-

hiking Activities

-

pets Animals & Pets

-

domain_add Building & Planning

-

store Business

-

account_tree City Administration

-

category City Assets & Data

-

explore City Regions

-

diversity_4 Community Support

-

theater_comedy Culture & History

-

business_center Employment

-

directions Infrastructure

-

gavel Law, Code & Compliance

-

payments Money

-

park Outdoors & Sustainability

-

local_police Safety

-

directions_car Transportation

-

delete_sweep Utility Services

-

Use the menus above to navigate by City Departments or Categories.

- Convention and Cultural Services

- Arts and Culture

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- City of Sacramento

- Entertainment Services Division

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Mayor Kevin McCarty

- Arts and Culture

- Arts and Culture

- Convention and Cultural Services

- Public Works

- Arts and Culture

- Access Leisure

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Community Engagement

- Community Engagement

- Youth, Parks, & Community Enrichment

- Older Adult Services

- Youth, Parks, & Community Enrichment

- Youth Workforce Development

- Older Adult Services

- Youth, Parks, & Community Enrichment

- Planning

- Arts and Culture

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Older Adult Services

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Parking

- Innovation and Economic Development

- Aquatics

- Convention and Cultural Services

- Convention and Cultural Services

- Arts and Culture

- Community Engagement

- Office of Public Safety Accountability

- Arts and Culture

- District 7 - Rick Jennings

- Police Department

- Convention and Cultural Services

- Convention and Cultural Services

- Fire Department

- Youth, Parks, & Community Enrichment

- Recycling & Solid Waste

- Arts and Culture

- Arts and Culture

- Planning

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Mayor Kevin McCarty

- Recycling & Solid Waste

- Entertainment Services Division

- Entertainment Services Division

- City of Sacramento

- Youth, Parks, & Community Enrichment

- Access Leisure

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Parks

- Mayor Kevin McCarty

- Parks

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Aquatics

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Animal Care

- Animal Care

- Community Development

- Animal Care

- Animal Care

- Animal Care

- Animal Care

- Animal Care

- Animal Care

- Parks

- Animal Care

- Animal Care

- Maintenance Services

- Planning

- City of Sacramento

- Community Development

- Building

- Community Development

- Building

- Building

- Building

- Building

- Recycling & Solid Waste

- Recycling & Solid Waste

- Maintenance Services

- Procurement Services Division

- Parks

- Utilities

- Public Works

- Engineering

- Fire Department

- Arts and Culture

- Building

- Building

- Building

- Building

- Engineering

- City of Sacramento

- Public Works

- Planning

- Mayor Kevin McCarty

- Engineering

- Planning

- Planning

- Fire Department

- Community Development

- Building

- Recycling & Solid Waste

- Fire Department

- Fire Department

- Community Development

- Community Development

- Community Development

- Innovation and Economic Development

- Planning

- Building

- Planning

- Planning

- Climate Action and Sustainability

- Planning

- Planning

- Public Works

- Parks

- Community Development

- Community Development

- Planning

- Office of the City Manager

- Public Works

- Planning

- Planning

- Public Works

- Mobility and Sustainability

- Transportation

- Planning

- Planning

- Arts and Culture

- Engineering

- Planning

- Planning

- Community Development

- Arts and Culture

- Innovation and Economic Development

- Planning

- Planning

- City of Sacramento

- Innovation and Economic Development

- Code Compliance

- Revenue Division

- Revenue Division

- Innovation and Economic Development

- Finance

- Recycling & Solid Waste

- Entertainment Services Division

- Innovation and Economic Development

- Innovation and Economic Development

- Procurement Services Division

- Mayor Kevin McCarty

- Revenue Division

- Innovation and Economic Development

- Planning

- Office of the City Auditor

- Office of the City Auditor

- Cannabis Management

- Cannabis Management

- Cannabis Management

- Revenue Division

- Cannabis Management

- Finance

- Cannabis Management

- Office of the City Auditor

- Cannabis Management

- Planning

- Parking

- Office of the City Manager

- Engineering

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Arts and Culture

- Community Engagement

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- District 1 - Lisa Kaplan

- Transportation Planning

- Innovation and Economic Development

- Office of the City Manager

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Mayor Kevin McCarty

- Innovation and Economic Development

- Mayor Kevin McCarty

- Innovation and Economic Development

- Information Technology

- Information Technology

- Engineering

- Arts and Culture

- Office of the City Manager

- Innovation and Economic Development

- Finance

- Finance

- Police Department

- Procurement Services Division

- City of Sacramento

- Arts and Culture

- Code Compliance

- Code Compliance

- Recycling & Solid Waste

- Procurement Services Division

- Procurement Services Division

- City of Sacramento

- Recycling & Solid Waste

- Procurement Services Division

- Finance

- Finance

- Procurement Services Division

- Procurement Services Division

- Office of the City Auditor

- Police Department

- Office of the City Auditor

- Office of the City Auditor

- Finance

- Office of the City Clerk

- Arts and Culture

- City of Sacramento

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Public Works

- Diversity and Equity

- Office of the City Clerk

- Office of the City Auditor

- Community Development

- Community Development

- Community Development

- Community Development

- Community Development

- District 1 - Lisa Kaplan

- District 2 - Roger Dickinson

- Office of the City Auditor

- Office of the City Clerk

- Arts and Culture

- Youth, Parks, & Community Enrichment

- Police Department

- City of Sacramento

- Office of the City Clerk

- Office of the City Manager

- Office of the City Manager

- Office of the City Manager

- Community Engagement

- Community Engagement

- Community Engagement

- Arts and Culture

- Office of the City Manager

- Innovation and Economic Development

- Office of the City Manager

- Office of the City Manager

- Office of the City Manager

- City of Sacramento

- Planning

- Arts and Culture

- City of Sacramento

- Engineering

- City of Sacramento

- Planning

- City of Sacramento

- City of Sacramento

- City of Sacramento

- City of Sacramento

- Information Technology

- Information Technology

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Parking

- Youth, Parks, & Community Enrichment

- Finance

- Utilities

- Utilities

- Building

- Office of Public Safety Accountability

- Utilities

- Police Department

- Police Department

- Marina

- Police Department

- Police Department

- Police Department

- Office of the City Clerk

- City of Sacramento

- Arts and Culture

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Office of the City Clerk

- Mayor and Council

- City of Sacramento

- Diversity and Equity

- Office of the City Clerk

- Office of the City Auditor

- Office of Public Safety Accountability

- Office of the City Attorney

- Office of the City Auditor

- Office of the City Auditor

- Police Department

- Maps and Geographic Information Systems

- Office of Public Safety Accountability

- Police Department

- City of Sacramento

- Office of the City Auditor

- Planning

- Planning

- Planning

- Planning

- Arts and Culture

- Public Works

- Recycling & Solid Waste

- Arts and Culture

- Police Department

- Facilities & Real Property Management

- Public Works

- Youth, Parks, & Community Enrichment

- Climate Action and Sustainability

- Public Works

- Public Works

- Community Development

- Community Development

- Community Development

- Community Development

- Community Development

- Community Development

- Community Development

- Planning

- Police Department

- Convention and Cultural Services

- Arts and Culture

- Office of the City Clerk

- District 1 - Lisa Kaplan

- City of Sacramento

- Maps and Geographic Information Systems

- Arts and Culture

- Office of the City Clerk

- Office of the City Clerk

- Police Department

- Office of the City Auditor

- Office of Public Safety Accountability

- Office of the City Attorney

- Office of the City Auditor

- Office of the City Auditor

- Police Department

- Maps and Geographic Information Systems

- Office of Public Safety Accountability

- Police Department

- City of Sacramento

- Office of the City Auditor

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Maps and Geographic Information Systems

- Arts and Culture

- Office of the City Clerk

- Arts and Culture

- Planning

- Arts and Culture

- Arts and Culture

- Engineering

- Police Department

- Innovation and Economic Development

- Community Engagement

- Youth Workforce Development

- Arts and Culture

- Innovation and Economic Development

- Arts and Culture

- Transportation Planning

- Arts and Culture

- Planning

- Planning

- Arts and Culture

- District 5 - Caity Maple

- Arts and Culture

- Engineering

- Planning

- Planning

- Community Development

- Arts and Culture

- Innovation and Economic Development

- Planning

- Planning

- Youth, Parks, & Community Enrichment

- Parks

- Planning

- Arts and Culture

- City of Sacramento

- Parking

- Engineering

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Engineering

- Arts and Culture

- Public Works

- Youth, Parks, & Community Enrichment

- Maintenance Services

- City of Sacramento

- Older Adult Services

- Planning

- Engineering

- City of Sacramento

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Older Adult Services

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Planning

- Planning

- Planning

- Arts and Culture

- Planning

- Arts and Culture

- Innovation and Economic Development

- Community Engagement

- Innovation and Economic Development

- Office of Public Safety Accountability

- Diversity and Equity

- Join Sacramento Fire

- Innovation and Economic Development

- Office of the City Auditor

- Arts and Culture

- Responding to Homelessness

- Fire Department

- Office of the City Manager

- Office of the City Manager

- Police Department

- Police Department

- Youth Workforce Development

- Arts and Culture

- Police Department

- Community Development

- Arts and Culture

- Planning

- Diversity and Equity

- Youth Civic Engagement

- Transportation Planning

- Older Adult Services

- District 5 - Caity Maple

- Transportation Planning

- Access Leisure

- Access Leisure

- Access Leisure

- Cannabis Management

- Office of the City Auditor

- Office of the City Auditor

- Arts and Culture

- Arts and Culture

- Human Resources

- Community Engagement

- City of Sacramento

- Innovation and Economic Development

- Police Department

- Arts and Culture

- Community Response

- Mayor Kevin McCarty

- Community Response

- Innovation and Economic Development

- Police Department

- Community Response

- Mayor Kevin McCarty

- Community Response

- Planning

- Office of the City Manager

- Planning

- Mayor Kevin McCarty

- District 5 - Caity Maple

- Planning

- Mayor Kevin McCarty

- Planning

- Building

- Responding to Homelessness

- Planning

- Planning

- Planning

- Planning

- Responding to Homelessness

- Code Compliance

- Planning

- Revenue Division

- Innovation and Economic Development

- Mayor Kevin McCarty

- Planning

- District 5 - Caity Maple

- Planning

- Youth, Parks, & Community Enrichment

- Older Adult Services

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Older Adult Services

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Older Adult Services

- Planning

- District 5 - Caity Maple

- City of Sacramento

- Office of the City Auditor

- Animal Care

- District 7 - Rick Jennings

- District 1 - Lisa Kaplan

- Community Engagement

- Police Department

- Youth, Parks, & Community Enrichment

- Police Department

- Youth, Parks, & Community Enrichment

- Parks

- Aquatics

- Arts and Culture

- District 7 - Rick Jennings

- Youth, Parks, & Community Enrichment

- Convention and Cultural Services

- Join Sacramento Fire

- Youth, Parks, & Community Enrichment

- Aquatics

- Youth, Parks, & Community Enrichment

- Aquatics

- Office of the City Auditor

- Arts and Culture

- Police Department

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Arts and Culture

- Youth, Parks, & Community Enrichment

- Police Department

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Convention and Cultural Services

- Arts and Culture

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- City of Sacramento

- Entertainment Services Division

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Mayor Kevin McCarty

- Arts and Culture

- Arts and Culture

- Convention and Cultural Services

- Public Works

- Arts and Culture

- Parking

- Innovation and Economic Development

- Aquatics

- Convention and Cultural Services

- Convention and Cultural Services

- Arts and Culture

- Community Engagement

- Office of Public Safety Accountability

- Arts and Culture

- District 7 - Rick Jennings

- Police Department

- Convention and Cultural Services

- Convention and Cultural Services

- Fire Department

- Youth, Parks, & Community Enrichment

- Recycling & Solid Waste

- Arts and Culture

- Arts and Culture

- Planning

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Mayor Kevin McCarty

- Recycling & Solid Waste

- Entertainment Services Division

- Entertainment Services Division

- City of Sacramento

- Planning

- Planning

- Arts and Culture

- Convention and Cultural Services

- Office of the City Attorney

- Parks

- Planning

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Fire Department

- Convention and Cultural Services

- Public Works

- Office of the City Clerk

- Police Department

- Access Leisure

- Access Leisure

- Access Leisure

- Cannabis Management

- Office of the City Auditor

- Office of the City Auditor

- Arts and Culture

- Arts and Culture

- Human Resources

- Community Engagement

- City of Sacramento

- Innovation and Economic Development

- Police Department

- Arts and Culture

- Human Resources

- Human Resources

- Human Resources

- Human Resources

- City of Sacramento

- Human Resources

- Finance

- Youth, Parks, & Community Enrichment

- Human Resources

- Human Resources

- Human Resources

- City of Sacramento

- District 7 - Rick Jennings

- Fire Department

- Youth, Parks, & Community Enrichment

- Fire Department

- Employee & Retiree Benefits

- Youth Workforce Development

- Expanded Learning

- Police Department

- Office of the City Auditor

- Animal Care

- District 7 - Rick Jennings

- District 1 - Lisa Kaplan

- Community Engagement

- Police Department

- Youth, Parks, & Community Enrichment

- Police Department

- Arts and Culture

- Youth Workforce Development

- Innovation and Economic Development

- Engineering

- Engineering

- Engineering

- Engineering

- Transportation Planning

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- City of Sacramento

- Utilities

- Information Technology

- Information Technology

- Information Technology

- Information Technology

- Information Technology

- City of Sacramento

- Information Technology

- Information Technology

- Information Technology

- Information Technology

- City of Sacramento

- Fire Department

- Information Technology

- Information Technology

- Information Technology

- Recycling & Solid Waste

- City of Sacramento

- Finance

- City of Sacramento

- Finance

- Finance

- Finance

- Finance

- Building

- Utilities

- Utilities

- Fire Department

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- City of Sacramento

- Fire Department

- Maintenance Services

- Arts and Culture

- Arts and Culture

- Utilities

- Public Works

- Maintenance Services

- Public Works

- Public Works

- Police Department

- Arts and Culture

- City of Sacramento

- Engineering

- Maintenance Services

- Maintenance Services

- Maintenance Services

- Maintenance Services

- Recycling & Solid Waste

- Urban Forestry

- Public Works

- Transportation

- Mobility and Sustainability

- Engineering

- Transportation

- Transportation

- Park Planning & Development

- Arts and Culture

- Parks

- Public Works

- Engineering

- Parks

- Arts and Culture

- Engineering

- Engineering

- Engineering

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- City of Sacramento

- Community Development

- Community Development

- Code Compliance

- Arts and Culture

- Code Compliance

- Community Development

- Code Compliance

- Code Compliance

- Community Development

- Entertainment Services Division

- Fire Department

- Recycling & Solid Waste

- Code Compliance

- Recycling & Solid Waste

- Code Compliance

- Recycling & Solid Waste

- Parking

- Code Compliance

- Building

- Fire Department

- Community Development

- Building

- Recycling & Solid Waste

- Fire Department

- Fire Department

- Recycling & Solid Waste

- Cannabis Management

- City of Sacramento

- Recycling & Solid Waste

- Recycling & Solid Waste

- Parking

- Parking

- Fire Department

- Police Department

- Recycling & Solid Waste

- Arts and Culture

- Parking

- Parking

- Building

- Community Development

- Police Department

- Police Department

- Fire Department

- Recycling & Solid Waste

- Community Development

- Office of the City Clerk

- Code Compliance

- Revenue Division

- Cannabis Management

- Police Department

- Police Department

- Arts and Culture

- Engineering

- Police Department

- Entertainment Services Division

- Convention and Cultural Services

- Planning

- Entertainment Services Division

- Planning

- Public Works

- Mobility and Sustainability

- Public Works

- Building

- Youth, Parks, & Community Enrichment

- Innovation and Economic Development

- Building

- Police Department

- Public Works

- Revenue Division

- Recycling & Solid Waste

- Entertainment Services Division

- Building

- Mayor Kevin McCarty

- Urban Forestry

- Building

- Recycling & Solid Waste

- Planning

- Finance

- Finance

- City of Sacramento

- Finance

- Office of the City Auditor

- Recycling & Solid Waste

- Finance

- Mayor Kevin McCarty

- Office of the City Manager

- Finance

- Finance

- Finance

- City of Sacramento

- Office of the City Manager

- Mayor Kevin McCarty

- Access Leisure

- Planning

- Planning

- Utilities

- Older Adult Services

- Recycling & Solid Waste

- Parking

- Recycling & Solid Waste

- Utilities

- Youth, Parks, & Community Enrichment

- Aquatics

- Finance

- Revenue Division

- Youth, Parks, & Community Enrichment

- Office of the City Treasurer

- Office of the City Treasurer

- Office of the City Treasurer

- City of Sacramento

- Office of the City Treasurer

- Parking

- Office of the City Manager

- Engineering

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Arts and Culture

- Community Engagement

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- District 1 - Lisa Kaplan

- Transportation Planning

- Innovation and Economic Development

- Office of the City Manager

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Mayor Kevin McCarty

- Innovation and Economic Development

- Mayor Kevin McCarty

- Innovation and Economic Development

- Arts and Culture

- Cannabis Management

- Convention and Cultural Services

- Utilities

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Innovation and Economic Development

- Entertainment Services Division

- Innovation and Economic Development

- Innovation and Economic Development

- Recycling & Solid Waste

- Innovation and Economic Development

- Innovation and Economic Development

- Arts and Culture

- Engineering

- Youth, Parks, & Community Enrichment

- Finance

- City of Sacramento

- Finance

- Finance

- Finance

- Finance

- Building

- Office of the City Treasurer

- Office of the City Treasurer

- City of Sacramento

- Office of the City Treasurer

- Marina

- Building

- Revenue Division

- Cannabis Management

- Recycling & Solid Waste

- Revenue Division

- Utilities

- Utilities

- Fire Department

- Finance

- Community Engagement

- Marina

- Recycling & Solid Waste

- Arts and Culture

- Public Works

- Community Development

- Utilities

- City of Sacramento

- Finance

- Animal Care

- City of Sacramento

- Revenue Division

- Utilities

- Youth, Parks, & Community Enrichment

- Revenue Division

- Finance

- City of Sacramento

- Innovation and Economic Development

- Office of the City Manager

- Youth, Parks, & Community Enrichment

- Revenue Division

- Finance

- Revenue Division

- Revenue Division

- Transportation Planning

- Transportation Planning

- Arts and Culture

- Engineering

- Climate Action and Sustainability

- Planning

- Arts and Culture

- Transportation Planning

- Public Works

- Transportation Planning

- Transportation Planning

- Engineering

- Transportation Planning

- Engineering

- Transportation Planning

- Public Works

- City of Sacramento

- Access Leisure

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Maintenance Services

- Arts and Culture

- Planning

- Planning

- Climate Action and Sustainability

- Climate Action and Sustainability

- Mobility and Sustainability

- Climate Action and Sustainability

- Arts and Culture

- Climate Action and Sustainability

- Planning

- Public Works

- Public Works

- Climate Action and Sustainability

- Procurement Services Division

- Recycling & Solid Waste

- Building

- Utilities

- Climate Action and Sustainability

- Utilities

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Arts and Culture

- Youth, Parks, & Community Enrichment

- Public Works

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Information Technology

- Arts and Culture

- Recycling & Solid Waste

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Transportation Planning

- Youth, Parks, & Community Enrichment

- Access Leisure

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Parks

- Mayor Kevin McCarty

- Parks

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Aquatics

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Park Planning & Development

- Arts and Culture

- Parks

- Public Works

- Engineering

- Parks

- Arts and Culture

- Engineering

- Engineering

- Engineering

- Urban Forestry

- Parks

- Public Works

- Parks

- City of Sacramento

- Urban Forestry

- Urban Forestry

- Urban Forestry

- Climate Action and Sustainability

- Maintenance Services

- Fire Department

- Fire Department

- Planning

- Planning

- Parks

- Community Response

- Community Response

- City of Sacramento

- Office of the City Manager

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Fire Department

- Police Department

- Police Department

- Police Department

- Utilities

- Police Department

- Office of the City Auditor

- Office of the City Auditor

- Fire Department

- Fire Department

- Join Sacramento Fire

- Fire Department

- Fire Department

- Police Department

- Fire Department

- Join Sacramento Fire

- Join Sacramento Fire

- Emergency Management

- Fire Department

- Fire Department

- Fire Department

- Fire Department

- City of Sacramento

- Fire Department

- Fire Department

- Fire Department

- City of Sacramento

- Fire Department

- Fire Department

- Community Development

- Building

- Recycling & Solid Waste

- Fire Department

- Fire Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- City of Sacramento

- Police Department

- City of Sacramento

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Emergency Management

- Police Department

- Information Technology

- Utilities

- Fire Department

- District 1 - Lisa Kaplan

- Mobility and Sustainability

- Utilities

- Utilities

- Fire Department

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- City of Sacramento

- Fire Department

- Fire Department

- Fire Department

- Planning

- Planning

- Parks

- Transportation Planning

- Transportation Planning

- Arts and Culture

- Engineering

- Climate Action and Sustainability

- Planning

- Arts and Culture

- Transportation Planning

- Public Works

- Transportation Planning

- Transportation Planning

- Engineering

- Transportation Planning

- Engineering

- Transportation Planning

- Public Works

- City of Sacramento

- Mobility and Sustainability

- Engineering

- Transportation Planning

- Arts and Culture

- Transportation

- Transportation Planning

- Public Works

- Transportation Planning

- Parking

- Public Works

- Climate Action and Sustainability

- Transportation Planning

- Police Department

- Marina

- Marina

- Mobility and Sustainability

- Public Works

- Planning

- City of Sacramento

- Public Works

- Transportation Planning

- Recycling & Solid Waste

- Public Works

- Transportation Planning

- Engineering

- Transportation Planning

- Arts and Culture

- Engineering

- Engineering

- Transportation Planning

- Engineering

- Public Works

- Mobility and Sustainability

- Engineering

- Planning

- Transportation Planning

- Engineering

- Public Works

- City of Sacramento

- Public Works

- Police Department

- Public Works

- Transportation Planning

- Transportation

- Transportation Planning

- Transportation

- Transportation

- Engineering

- Transportation Planning

- Transportation Planning

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Transportation Planning

- Engineering

- Transportation

- Transportation Planning

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- City of Sacramento

- Utilities

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Public Works

- Climate Action and Sustainability

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Public Works

- Climate Action and Sustainability

- Recycling & Solid Waste

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- City of Sacramento

- City Departments

-

-

Community Development

-

Community Response

-

Convention and Cultural Services

-

Finance

-

Fire Department

-

Human Resources

-

Information Technology

-

Mayor and Council

-

Office of Public Safety Accountability

-

Office of the City Attorney

-

Office of the City Auditor

-

Office of the City Clerk

-

Office of the City Manager

-

Office of the City Treasurer

-

Police Department

-

Public Works

-

Utilities

-

Youth, Parks, & Community Enrichment

-

- Browse by categories

-

-

hiking Activities

-

pets Animals & Pets

-

domain_add Building & Planning

-

store Business

-

account_tree City Administration

-

category City Assets & Data

-

explore City Regions

-

diversity_4 Community Support

-

theater_comedy Culture & History

-

business_center Employment

-

directions Infrastructure

-

gavel Law, Code & Compliance

-

payments Money

-

park Outdoors & Sustainability

-

local_police Safety

-

directions_car Transportation

-

delete_sweep Utility Services

-

Use the menus above to navigate by City Departments or Categories.

You can also use the Search function below to find specific content on our site.

- Convention and Cultural Services

- Arts and Culture

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- City of Sacramento

- Entertainment Services Division

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Mayor Kevin McCarty

- Arts and Culture

- Arts and Culture

- Convention and Cultural Services

- Public Works

- Arts and Culture

- Access Leisure

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Community Engagement

- Community Engagement

- Youth, Parks, & Community Enrichment

- Older Adult Services

- Youth, Parks, & Community Enrichment

- Youth Workforce Development

- Older Adult Services

- Youth, Parks, & Community Enrichment

- Planning

- Arts and Culture

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Older Adult Services

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Parking

- Innovation and Economic Development

- Aquatics

- Convention and Cultural Services

- Convention and Cultural Services

- Arts and Culture

- Community Engagement

- Office of Public Safety Accountability

- Arts and Culture

- District 7 - Rick Jennings

- Police Department

- Convention and Cultural Services

- Convention and Cultural Services

- Fire Department

- Youth, Parks, & Community Enrichment

- Recycling & Solid Waste

- Arts and Culture

- Arts and Culture

- Planning

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Mayor Kevin McCarty

- Recycling & Solid Waste

- Entertainment Services Division

- Entertainment Services Division

- City of Sacramento

- Youth, Parks, & Community Enrichment

- Access Leisure

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Parks

- Mayor Kevin McCarty

- Parks

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Aquatics

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Animal Care

- Animal Care

- Community Development

- Animal Care

- Animal Care

- Animal Care

- Animal Care

- Animal Care

- Animal Care

- Parks

- Animal Care

- Animal Care

- Maintenance Services

- Planning

- City of Sacramento

- Community Development

- Building

- Community Development

- Building

- Building

- Building

- Building

- Recycling & Solid Waste

- Recycling & Solid Waste

- Maintenance Services

- Procurement Services Division

- Parks

- Utilities

- Public Works

- Engineering

- Fire Department

- Arts and Culture

- Building

- Building

- Building

- Building

- Engineering

- City of Sacramento

- Public Works

- Planning

- Mayor Kevin McCarty

- Engineering

- Planning

- Planning

- Fire Department

- Community Development

- Building

- Recycling & Solid Waste

- Fire Department

- Fire Department

- Community Development

- Community Development

- Community Development

- Innovation and Economic Development

- Planning

- Building

- Planning

- Planning

- Climate Action and Sustainability

- Planning

- Planning

- Public Works

- Parks

- Community Development

- Community Development

- Planning

- Office of the City Manager

- Public Works

- Planning

- Planning

- Public Works

- Mobility and Sustainability

- Transportation

- Planning

- Planning

- Arts and Culture

- Engineering

- Planning

- Planning

- Community Development

- Arts and Culture

- Innovation and Economic Development

- Planning

- Planning

- City of Sacramento

- Innovation and Economic Development

- Code Compliance

- Revenue Division

- Revenue Division

- Innovation and Economic Development

- Finance

- Recycling & Solid Waste

- Entertainment Services Division

- Innovation and Economic Development

- Innovation and Economic Development

- Procurement Services Division

- Mayor Kevin McCarty

- Revenue Division

- Innovation and Economic Development

- Planning

- Office of the City Auditor

- Office of the City Auditor

- Cannabis Management

- Cannabis Management

- Cannabis Management

- Revenue Division

- Cannabis Management

- Finance

- Cannabis Management

- Office of the City Auditor

- Cannabis Management

- Planning

- Parking

- Office of the City Manager

- Engineering

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Arts and Culture

- Community Engagement

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- District 1 - Lisa Kaplan

- Transportation Planning

- Innovation and Economic Development

- Office of the City Manager

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Mayor Kevin McCarty

- Innovation and Economic Development

- Mayor Kevin McCarty

- Innovation and Economic Development

- Information Technology

- Information Technology

- Engineering

- Arts and Culture

- Office of the City Manager

- Innovation and Economic Development

- Finance

- Finance

- Police Department

- Procurement Services Division

- City of Sacramento

- Arts and Culture

- Code Compliance

- Code Compliance

- Recycling & Solid Waste

- Procurement Services Division

- Procurement Services Division

- City of Sacramento

- Recycling & Solid Waste

- Procurement Services Division

- Finance

- Finance

- Procurement Services Division

- Procurement Services Division

- Office of the City Auditor

- Police Department

- Office of the City Auditor

- Office of the City Auditor

- Finance

- Office of the City Clerk

- Arts and Culture

- City of Sacramento

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Public Works

- Diversity and Equity

- Office of the City Clerk

- Office of the City Auditor

- Community Development

- Community Development

- Community Development

- Community Development

- Community Development

- District 1 - Lisa Kaplan

- District 2 - Roger Dickinson

- Office of the City Auditor

- Office of the City Clerk

- Arts and Culture

- Youth, Parks, & Community Enrichment

- Police Department

- City of Sacramento

- Office of the City Clerk

- Office of the City Manager

- Office of the City Manager

- Office of the City Manager

- Community Engagement

- Community Engagement

- Community Engagement

- Arts and Culture

- Office of the City Manager

- Innovation and Economic Development

- Office of the City Manager

- Office of the City Manager

- Office of the City Manager

- City of Sacramento

- Planning

- Arts and Culture

- City of Sacramento

- Engineering

- City of Sacramento

- Planning

- City of Sacramento

- City of Sacramento

- City of Sacramento

- City of Sacramento

- Information Technology

- Information Technology

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Parking

- Youth, Parks, & Community Enrichment

- Finance

- Utilities

- Utilities

- Building

- Office of Public Safety Accountability

- Utilities

- Police Department

- Police Department

- Marina

- Police Department

- Police Department

- Police Department

- Office of the City Clerk

- City of Sacramento

- Arts and Culture

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Office of the City Clerk

- Mayor and Council

- City of Sacramento

- Diversity and Equity

- Office of the City Clerk

- Office of the City Auditor

- Office of Public Safety Accountability

- Office of the City Attorney

- Office of the City Auditor

- Office of the City Auditor

- Police Department

- Maps and Geographic Information Systems

- Office of Public Safety Accountability

- Police Department

- City of Sacramento

- Office of the City Auditor

- Planning

- Planning

- Planning

- Planning

- Arts and Culture

- Public Works

- Recycling & Solid Waste

- Arts and Culture

- Police Department

- Facilities & Real Property Management

- Public Works

- Youth, Parks, & Community Enrichment

- Climate Action and Sustainability

- Public Works

- Public Works

- Community Development

- Community Development

- Community Development

- Community Development

- Community Development

- Community Development

- Community Development

- Planning

- Police Department

- Convention and Cultural Services

- Arts and Culture

- Office of the City Clerk

- District 1 - Lisa Kaplan

- City of Sacramento

- Maps and Geographic Information Systems

- Arts and Culture

- Office of the City Clerk

- Office of the City Clerk

- Police Department

- Office of the City Auditor

- Office of Public Safety Accountability

- Office of the City Attorney

- Office of the City Auditor

- Office of the City Auditor

- Police Department

- Maps and Geographic Information Systems

- Office of Public Safety Accountability

- Police Department

- City of Sacramento

- Office of the City Auditor

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Maps and Geographic Information Systems

- Arts and Culture

- Office of the City Clerk

- Arts and Culture

- Planning

- Arts and Culture

- Arts and Culture

- Engineering

- Police Department

- Innovation and Economic Development

- Community Engagement

- Youth Workforce Development

- Arts and Culture

- Innovation and Economic Development

- Arts and Culture

- Transportation Planning

- Arts and Culture

- Planning

- Planning

- Arts and Culture

- District 5 - Caity Maple

- Arts and Culture

- Engineering

- Planning

- Planning

- Community Development

- Arts and Culture

- Innovation and Economic Development

- Planning

- Planning

- Youth, Parks, & Community Enrichment

- Parks

- Planning

- Arts and Culture

- City of Sacramento

- Parking

- Engineering

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Engineering

- Arts and Culture

- Public Works

- Youth, Parks, & Community Enrichment

- Maintenance Services

- City of Sacramento

- Older Adult Services

- Planning

- Engineering

- City of Sacramento

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Older Adult Services

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Planning

- Planning

- Planning

- Arts and Culture

- Planning

- Arts and Culture

- Innovation and Economic Development

- Community Engagement

- Innovation and Economic Development

- Office of Public Safety Accountability

- Diversity and Equity

- Join Sacramento Fire

- Innovation and Economic Development

- Office of the City Auditor

- Arts and Culture

- Responding to Homelessness

- Fire Department

- Office of the City Manager

- Office of the City Manager

- Police Department

- Police Department

- Youth Workforce Development

- Arts and Culture

- Police Department

- Community Development

- Arts and Culture

- Planning

- Diversity and Equity

- Youth Civic Engagement

- Transportation Planning

- Older Adult Services

- District 5 - Caity Maple

- Transportation Planning

- Access Leisure

- Access Leisure

- Access Leisure

- Cannabis Management

- Office of the City Auditor

- Office of the City Auditor

- Arts and Culture

- Arts and Culture

- Human Resources

- Community Engagement

- City of Sacramento

- Innovation and Economic Development

- Police Department

- Arts and Culture

- Community Response

- Mayor Kevin McCarty

- Community Response

- Innovation and Economic Development

- Police Department

- Community Response

- Mayor Kevin McCarty

- Community Response

- Planning

- Office of the City Manager

- Planning

- Mayor Kevin McCarty

- District 5 - Caity Maple

- Planning

- Mayor Kevin McCarty

- Planning

- Building

- Responding to Homelessness

- Planning

- Planning

- Planning

- Planning

- Responding to Homelessness

- Code Compliance

- Planning

- Revenue Division

- Innovation and Economic Development

- Mayor Kevin McCarty

- Planning

- District 5 - Caity Maple

- Planning

- Youth, Parks, & Community Enrichment

- Older Adult Services

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Older Adult Services

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Older Adult Services

- Planning

- District 5 - Caity Maple

- City of Sacramento

- Office of the City Auditor

- Animal Care

- District 7 - Rick Jennings

- District 1 - Lisa Kaplan

- Community Engagement

- Police Department

- Youth, Parks, & Community Enrichment

- Police Department

- Youth, Parks, & Community Enrichment

- Parks

- Aquatics

- Arts and Culture

- District 7 - Rick Jennings

- Youth, Parks, & Community Enrichment

- Convention and Cultural Services

- Join Sacramento Fire

- Youth, Parks, & Community Enrichment

- Aquatics

- Youth, Parks, & Community Enrichment

- Aquatics

- Office of the City Auditor

- Arts and Culture

- Police Department

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Arts and Culture

- Youth, Parks, & Community Enrichment

- Police Department

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Convention and Cultural Services

- Arts and Culture

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- City of Sacramento

- Entertainment Services Division

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Mayor Kevin McCarty

- Arts and Culture

- Arts and Culture

- Convention and Cultural Services

- Public Works

- Arts and Culture

- Parking

- Innovation and Economic Development

- Aquatics

- Convention and Cultural Services

- Convention and Cultural Services

- Arts and Culture

- Community Engagement

- Office of Public Safety Accountability

- Arts and Culture

- District 7 - Rick Jennings

- Police Department

- Convention and Cultural Services

- Convention and Cultural Services

- Fire Department

- Youth, Parks, & Community Enrichment

- Recycling & Solid Waste

- Arts and Culture

- Arts and Culture

- Planning

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Mayor Kevin McCarty

- Recycling & Solid Waste

- Entertainment Services Division

- Entertainment Services Division

- City of Sacramento

- Planning

- Planning

- Arts and Culture

- Convention and Cultural Services

- Office of the City Attorney

- Parks

- Planning

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Fire Department

- Convention and Cultural Services

- Public Works

- Office of the City Clerk

- Police Department

- Access Leisure

- Access Leisure

- Access Leisure

- Cannabis Management

- Office of the City Auditor

- Office of the City Auditor

- Arts and Culture

- Arts and Culture

- Human Resources

- Community Engagement

- City of Sacramento

- Innovation and Economic Development

- Police Department

- Arts and Culture

- Human Resources

- Human Resources

- Human Resources

- Human Resources

- City of Sacramento

- Human Resources

- Finance

- Youth, Parks, & Community Enrichment

- Human Resources

- Human Resources

- Human Resources

- City of Sacramento

- District 7 - Rick Jennings

- Fire Department

- Youth, Parks, & Community Enrichment

- Fire Department

- Employee & Retiree Benefits

- Youth Workforce Development

- Expanded Learning

- Police Department

- Office of the City Auditor

- Animal Care

- District 7 - Rick Jennings

- District 1 - Lisa Kaplan

- Community Engagement

- Police Department

- Youth, Parks, & Community Enrichment

- Police Department

- Arts and Culture

- Youth Workforce Development

- Innovation and Economic Development

- Engineering

- Engineering

- Engineering

- Engineering

- Transportation Planning

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- City of Sacramento

- Utilities

- Information Technology

- Information Technology

- Information Technology

- Information Technology

- Information Technology

- City of Sacramento

- Information Technology

- Information Technology

- Information Technology

- Information Technology

- City of Sacramento

- Fire Department

- Information Technology

- Information Technology

- Information Technology

- Recycling & Solid Waste

- City of Sacramento

- Finance

- City of Sacramento

- Finance

- Finance

- Finance

- Finance

- Building

- Utilities

- Utilities

- Fire Department

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- City of Sacramento

- Fire Department

- Maintenance Services

- Arts and Culture

- Arts and Culture

- Utilities

- Public Works

- Maintenance Services

- Public Works

- Public Works

- Police Department

- Arts and Culture

- City of Sacramento

- Engineering

- Maintenance Services

- Maintenance Services

- Maintenance Services

- Maintenance Services

- Recycling & Solid Waste

- Urban Forestry

- Public Works

- Transportation

- Mobility and Sustainability

- Engineering

- Transportation

- Transportation

- Park Planning & Development

- Arts and Culture

- Parks

- Public Works

- Engineering

- Parks

- Arts and Culture

- Engineering

- Engineering

- Engineering

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- City of Sacramento

- Community Development

- Community Development

- Code Compliance

- Arts and Culture

- Code Compliance

- Community Development

- Code Compliance

- Code Compliance

- Community Development

- Entertainment Services Division

- Fire Department

- Recycling & Solid Waste

- Code Compliance

- Recycling & Solid Waste

- Code Compliance

- Recycling & Solid Waste

- Parking

- Code Compliance

- Building

- Fire Department

- Community Development

- Building

- Recycling & Solid Waste

- Fire Department

- Fire Department

- Recycling & Solid Waste

- Cannabis Management

- City of Sacramento

- Recycling & Solid Waste

- Recycling & Solid Waste

- Parking

- Parking

- Fire Department

- Police Department

- Recycling & Solid Waste

- Arts and Culture

- Parking

- Parking

- Building

- Community Development

- Police Department

- Police Department

- Fire Department

- Recycling & Solid Waste

- Community Development

- Office of the City Clerk

- Code Compliance

- Revenue Division

- Cannabis Management

- Police Department

- Police Department

- Arts and Culture

- Engineering

- Police Department

- Entertainment Services Division

- Convention and Cultural Services

- Planning

- Entertainment Services Division

- Planning

- Public Works

- Mobility and Sustainability

- Public Works

- Building

- Youth, Parks, & Community Enrichment

- Innovation and Economic Development

- Building

- Police Department

- Public Works

- Revenue Division

- Recycling & Solid Waste

- Entertainment Services Division

- Building

- Mayor Kevin McCarty

- Urban Forestry

- Building

- Recycling & Solid Waste

- Planning

- Finance

- Finance

- City of Sacramento

- Finance

- Office of the City Auditor

- Recycling & Solid Waste

- Finance

- Mayor Kevin McCarty

- Office of the City Manager

- Finance

- Finance

- Finance

- City of Sacramento

- Office of the City Manager

- Mayor Kevin McCarty

- Access Leisure

- Planning

- Planning

- Utilities

- Older Adult Services

- Recycling & Solid Waste

- Parking

- Recycling & Solid Waste

- Utilities

- Youth, Parks, & Community Enrichment

- Aquatics

- Finance

- Revenue Division

- Youth, Parks, & Community Enrichment

- Office of the City Treasurer

- Office of the City Treasurer

- Office of the City Treasurer

- City of Sacramento

- Office of the City Treasurer

- Parking

- Office of the City Manager

- Engineering

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Arts and Culture

- Community Engagement

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- District 1 - Lisa Kaplan

- Transportation Planning

- Innovation and Economic Development

- Office of the City Manager

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Mayor Kevin McCarty

- Innovation and Economic Development

- Mayor Kevin McCarty

- Innovation and Economic Development

- Arts and Culture

- Cannabis Management

- Convention and Cultural Services

- Utilities

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Innovation and Economic Development

- Entertainment Services Division

- Innovation and Economic Development

- Innovation and Economic Development

- Recycling & Solid Waste

- Innovation and Economic Development

- Innovation and Economic Development

- Arts and Culture

- Engineering

- Youth, Parks, & Community Enrichment

- Finance

- City of Sacramento

- Finance

- Finance

- Finance

- Finance

- Building

- Office of the City Treasurer

- Office of the City Treasurer

- City of Sacramento

- Office of the City Treasurer

- Marina

- Building

- Revenue Division

- Cannabis Management

- Recycling & Solid Waste

- Revenue Division

- Utilities

- Utilities

- Fire Department

- Finance

- Community Engagement

- Marina

- Recycling & Solid Waste

- Arts and Culture

- Public Works

- Community Development

- Utilities

- City of Sacramento

- Finance

- Animal Care

- City of Sacramento

- Revenue Division

- Utilities

- Youth, Parks, & Community Enrichment

- Revenue Division

- Finance

- City of Sacramento

- Innovation and Economic Development

- Office of the City Manager

- Youth, Parks, & Community Enrichment

- Revenue Division

- Finance

- Revenue Division

- Revenue Division

- Transportation Planning

- Transportation Planning

- Arts and Culture

- Engineering

- Climate Action and Sustainability

- Planning

- Arts and Culture

- Transportation Planning

- Public Works

- Transportation Planning

- Transportation Planning

- Engineering

- Transportation Planning

- Engineering

- Transportation Planning

- Public Works

- City of Sacramento

- Access Leisure

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Maintenance Services

- Arts and Culture

- Planning

- Planning

- Climate Action and Sustainability

- Climate Action and Sustainability

- Mobility and Sustainability

- Climate Action and Sustainability

- Arts and Culture

- Climate Action and Sustainability

- Planning

- Public Works

- Public Works

- Climate Action and Sustainability

- Procurement Services Division

- Recycling & Solid Waste

- Building

- Utilities

- Climate Action and Sustainability

- Utilities

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Arts and Culture

- Youth, Parks, & Community Enrichment

- Public Works

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Arts and Culture

- Information Technology

- Arts and Culture

- Recycling & Solid Waste

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Transportation Planning

- Youth, Parks, & Community Enrichment

- Access Leisure

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Parks

- Mayor Kevin McCarty

- Parks

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Aquatics

- Youth, Parks, & Community Enrichment

- City of Sacramento

- Park Planning & Development

- Arts and Culture

- Parks

- Public Works

- Engineering

- Parks

- Arts and Culture

- Engineering

- Engineering

- Engineering

- Urban Forestry

- Parks

- Public Works

- Parks

- City of Sacramento

- Urban Forestry

- Urban Forestry

- Urban Forestry

- Climate Action and Sustainability

- Maintenance Services

- Fire Department

- Fire Department

- Planning

- Planning

- Parks

- Community Response

- Community Response

- City of Sacramento

- Office of the City Manager

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Fire Department

- Police Department

- Police Department

- Police Department

- Utilities

- Police Department

- Office of the City Auditor

- Office of the City Auditor

- Fire Department

- Fire Department

- Join Sacramento Fire

- Fire Department

- Fire Department

- Police Department

- Fire Department

- Join Sacramento Fire

- Join Sacramento Fire

- Emergency Management

- Fire Department

- Fire Department

- Fire Department

- Fire Department

- City of Sacramento

- Fire Department

- Fire Department

- Fire Department

- City of Sacramento

- Fire Department

- Fire Department

- Community Development

- Building

- Recycling & Solid Waste

- Fire Department

- Fire Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- City of Sacramento

- Police Department

- City of Sacramento

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Police Department

- Emergency Management

- Police Department

- Information Technology

- Utilities

- Fire Department

- District 1 - Lisa Kaplan

- Mobility and Sustainability

- Utilities

- Utilities

- Fire Department

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- City of Sacramento

- Fire Department

- Fire Department

- Fire Department

- Planning

- Planning

- Parks

- Transportation Planning

- Transportation Planning

- Arts and Culture

- Engineering

- Climate Action and Sustainability

- Planning

- Arts and Culture

- Transportation Planning

- Public Works

- Transportation Planning

- Transportation Planning

- Engineering

- Transportation Planning

- Engineering

- Transportation Planning

- Public Works

- City of Sacramento

- Mobility and Sustainability

- Engineering

- Transportation Planning

- Arts and Culture

- Transportation

- Transportation Planning

- Public Works

- Transportation Planning

- Parking

- Public Works

- Climate Action and Sustainability

- Transportation Planning

- Police Department

- Marina

- Marina

- Mobility and Sustainability

- Public Works

- Planning

- City of Sacramento

- Public Works

- Transportation Planning

- Recycling & Solid Waste

- Public Works

- Transportation Planning

- Engineering

- Transportation Planning

- Arts and Culture

- Engineering

- Engineering

- Transportation Planning

- Engineering

- Public Works

- Mobility and Sustainability

- Engineering

- Planning

- Transportation Planning

- Engineering

- Public Works

- City of Sacramento

- Public Works

- Police Department

- Public Works

- Transportation Planning

- Transportation

- Transportation Planning

- Transportation

- Transportation

- Engineering

- Transportation Planning

- Transportation Planning

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Transportation Planning

- Engineering

- Transportation

- Transportation Planning

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- City of Sacramento

- Utilities

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Public Works

- Climate Action and Sustainability

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Public Works

- Climate Action and Sustainability

- Recycling & Solid Waste

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- City of Sacramento

Search or ask

Budget Division

open_in_full

open_in_full

Budget, Policy, and Strategic Planning

The Budget, Policy and Strategic Planning Division is primarily responsible for the development and preparation of the City of Sacramento’s annual operating budget and Capital Improvement Program budget. In addition, staff provides analysis and recommendations regarding fiscal and operational issues to the City Manager’s Office, the City Council, Charter Offices, and City operating departments.

Fiscal Year (FY) 2026/27 Budget Development

FY2025/26 Approved Budget Documents

FY2025/26 Budget Development

FY2024/25 Budget Development

Budget Process

open_in_full

open_in_full

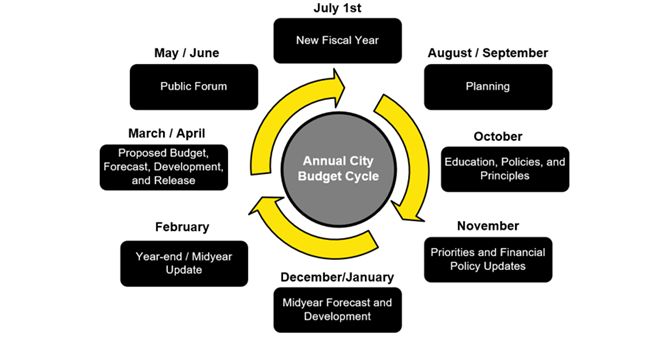

The following represents the City's budget/program planning cycle.

The City's fiscal year is July 1 through June 30. As such, the City Council annually adopts the City's operating and capital budgets for a single fiscal year beginning July 1 and ending June 30 in the subsequent calendar year.

To establish the annual budget, the Budget Division of the Finance Department develops a plan for expenditure of projected available resources for the coming Fiscal Year. Labor costs are updated to reflect salary and benefit changes called for in union contracts and estimates for unrepresented employees are also updated. A five-year revenue projection (based on the prior year actual receipts) and economic and revenue forecasts are used to determine what resources, tax revenues, and other discretionary revenues will be available to support operating requirements. Similarly, Capital Involvement Program priorities are married with available funds from eligible funding sources.

A base budget is prepared from this information. This base budget updates the costs of maintaining service and staffing levels into the new budget year. The base budget also includes the updated estimates of revenues and other financing sources. The base budget contains the operating and capital budgets.

Proposed operating and capital budget documents are prepared and transmitted to the Mayor and City Council as required by City Charter on or before May 1 of each year. The Mayor and Council review the proposed operating and capital improvement budget in public hearings. The budget is formally adopted by the vote of City Council on or before June 30 of each year. Any changes to the proposed budget, as considered and approved by the City Council during budget hearings, are included in the Approved Budget document.

Budget timeline

The budgeting process is reflected in the following timeline:

July 1st – New Fiscal Year

August-September – Planning

- Staff planning for budget implementation

- Identification of issues to be considered for future budget development

October – Education, Policies, and Principles

- Administrative work related to close of prior fiscal year

- Staff briefs Council on critical fiscal issues for future budget development

- Review of budget objectives and principles

November – Priorities and Financial Policy Updates

- Establish budget objectives and principles

- Provide policy direction for year-end results

- Consider policy direction for marginal budget adjustments