- City Departments

-

-

Community Development

-

Community Response

-

Convention and Cultural Services

-

Finance

-

Fire Department

-

Human Resources

-

Information Technology

-

Mayor and Council

-

Office of Public Safety Accountability

-

Office of the City Attorney

-

Office of the City Auditor

-

Office of the City Clerk

-

Office of the City Manager

-

Office of the City Treasurer

-

Police Department

-

Public Works

-

Utilities

-

Youth, Parks, & Community Enrichment

-

- Browse by categories

-

-

hiking Activities

-

pets Animals & Pets

-

domain_add Building & Planning

-

store Business

-

account_tree City Administration

-

category City Assets & Data

-

explore City Regions

-

diversity_4 Community Support

-

theater_comedy Culture & History

-

business_center Employment

-

directions Infrastructure

-

gavel Law, Code & Compliance

-

payments Money

-

park Outdoors & Sustainability

-

local_police Safety

-

directions_car Transportation

-

delete_sweep Utility Services

-

Use the menus above to navigate by City Departments or Categories.

- Convention and Cultural Services

- Arts and Culture

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Home

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Convention and Cultural Services

- Recreation

- Recreation

- Youth, Parks, & Community Enrichment

- Community Engagement

- Community Engagement

- About YPCE

- Hart Senior Center

- Recreation

- Youth Workforce Development

- Older Adult Services

- Youth, Parks, & Community Enrichment

- Long Range

- Youth, Parks, & Community Enrichment

- Recreation

- Recreation

- Recreation

- Home

- Youth, Parks, & Community Enrichment

- About YPCE

- About YPCE

- Older Adult Services

- Recreation

- Home

- Parking

- Innovation and Grants

- Aquatics

- CCS Partners

- Convention and Cultural Services

- Community Engagement

- District 7 - Rick Jennings

- Request a Permit

- CCS Partners

- Fire Department

- About YPCE

- Recycling & Solid Waste

- River District Specific Plan

- Convention and Cultural Services

- CCS Partners

- Emergency Management

- CCS Partners

- Commercial Waste Services

- Home

- Recreation

- Access Leisure

- Recreation

- Recreation

- Recreation

- Specialty Parks

- Specialty Parks

- Permits for YPCE

- Recreation

- Youth, Parks, & Community Enrichment

- About YPCE

- Youth, Parks, & Community Enrichment

- Aquatics

- Recreation

- Home

- Animal Care

- Animal Care

- Community Development

- Animal Care

- Animal Care

- Animal Care

- Animal Care

- Animal Care

- Specialty Parks

- Animal Care

- Animal Care

- Street Landscape Maintenance

- Accessory Dwelling Units

- City Government

- Community Development

- Building

- Contact CDD

- Building

- Building

- Building

- Building

- Business Waste Requirements

- Commercial Waste Services

- Maintenance Services

- Procurement Services Division

- Parks

- Utilities

- Public Works

- Engineering

- Fire Prevention

- Building

- Building

- Building

- Building

- Engineering

- Home

- Public Works

- Housing

- Engineering

- Housing

- Planning

- Fire Prevention

- Contact CDD

- Building

- Fire Prevention

- Fire Prevention

- Community Development

- Community Development

- Building Programs

- Community Development

- Transportation

- Locate & Grow in Sacramento

- Planning

- Planning

- Planning

- Climate Action Initiatives

- Planning

- Planning

- Parks

- Community Development

- Community Development

- Planning

- List of City Manager's Office Projects and Programs

- Public Works

- Planning

- Planning

- Public Works

- Transportation

- Planning

- Planning

- Engineering

- 102-Acre Site

- Community Development Meetings and Hearings

- Major Planning Projects

- Locate & Grow in Sacramento

- Major Planning Projects

- Planning

- City Government

- Innovation and Economic Development

- Innovation and Economic Development

- Code Compliance

- Revenue Division

- Office of the City Manager

- Recycling & Solid Waste

- Business

- Business

- Procurement Services Division

- Revenue Division

- Business

- Revenue Division

- Major Planning Projects

- City Auditor Reports

- City Auditor Reports

- Cannabis Management

- Cannabis Management

- Cannabis Management

- Business Operations Tax

- Cannabis Management

- Office of the City Manager

- Cannabis Management

- City Auditor Reports

- Cannabis Management

- Major Planning Projects

- Parking

- COVID-19 Relief & Recovery

- Innovation and Economic Development

- Innovation and Economic Development

- Business

- Community Engagement

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Office of the City Manager

- Business

- Business

- Innovation and Economic Development

- Innovation and Economic Development

- Business

- Innovation and Economic Development

- Office of the City Manager

- Business

- Finance

- Accounting Division

- Police Services

- Procurement Services Division

- City Government

- Code Compliance Programs

- Code Compliance Programs

- Commercial Waste Services

- Procurement Services Division

- Procurement Services Division

- Home

- Commercial Waste Services

- Procurement Services Division

- Finance

- Finance

- Procurement Services Division

- Procurement Services Division

- Office of the City Auditor

- Police Transparency

- Office of the City Auditor

- Office of the City Auditor

- Accounting Division

- Office of the City Clerk

- Home

- About YPCE

- Arts and Culture

- Diversity and Equity

- Records Management

- Office of the City Auditor

- Director Hearings

- Director Hearings

- Director Hearings

- Director Hearings

- District 1 - Lisa Kaplan

- District 2 - Roger Dickinson

- City Auditor Reports

- Office of the City Clerk

- About YPCE

- Police Transparency

- Home

- Records Management

- Office of the City Manager

- Office of the City Manager

- Neighborhood Directory

- Neighborhood Directory

- Community Engagement

- Office of the City Clerk

- Office of the City Manager

- Innovation and Grants

- Office of the City Manager

- Office of the City Manager

- Office of the City Manager

- Home

- River District Specific Plan

- City Government

- Engineering

- City Government

- Long Range

- City Government

- City Government

- City Government

- City Government

- Information Technology

- Camp Sacramento

- Parking

- About YPCE

- Finance

- Drinking Water Quality

- Utilities

- Office of Public Safety Accountability

- Pay Your Utility Bill

- Police Services

- Police Services

- Marina

- Police Services

- Contact Us

- Police Services

- Office of the City Clerk

- Home

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Office of the City Clerk

- Mayor and Council

- Home

- Diversity and Equity

- Office of the City Auditor

- Office of Public Safety Accountability

- About the City Attorney's Office

- Office of the City Auditor

- Office of the City Auditor

- Police Department

- Maps and Geographic Information Systems

- Office of Public Safety Accountability

- Police Department

- City Government

- Office of the City Auditor

- Sacramento for All: Housing Education Resource Center

- 102-Acre Site

- 102-Acre Site

- 102-Acre Site

- Public Works

- Construction & Demolition Recycling

- About SPD

- Facilities & Real Property Management

- Public Works

- Adult Sports Activities and Resources

- Climate Action Initiatives

- Fleet Services

- Public Works

- Director Hearings

- Director Hearings

- Director Hearings

- Director Hearings

- Director Hearings

- Director Hearings

- General Plans

- Police Transparency

- Convention and Cultural Services

- Legislative Management

- District 1 - Lisa Kaplan

- Home

- Maps and Geographic Information Systems

- Office of the City Clerk

- Police Services

- Office of the City Auditor

- Office of Public Safety Accountability

- About the City Attorney's Office

- Office of the City Auditor

- Office of the City Auditor

- Police Department

- Maps and Geographic Information Systems

- Office of Public Safety Accountability

- Police Department

- City Government

- Office of the City Auditor

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Maps and Geographic Information Systems

- City Elections

- Community Resources and Financial Empowerment

- Long Range

- Community Engagement

- Youth Workforce Development

- Locate & Grow in Sacramento

- Major Planning Projects

- Public Art Projects

- Engineering

- 102-Acre Site

- Community Development Meetings and Hearings

- Major Planning Projects

- Locate & Grow in Sacramento

- Major Planning Projects

- Planning

- Youth, Parks, & Community Enrichment

- Specialty Parks

- Long Range

- City Government

- List of City Manager's Office Projects and Programs

- Parking

- Transportation Projects

- About YPCE

- Home

- Engineering Programs & Services

- About OAC

- Youth, Parks, & Community Enrichment

- Maintenance Services

- City Government

- Older Adult Services

- Housing

- Home

- Youth, Parks, & Community Enrichment

- About YPCE

- About YPCE

- Older Adult Services

- Recreation

- Home

- 102-Acre Site

- Sacramento for All: Housing Education Resource Center

- Long Range

- City Auditor Reports

- Priority Projects/Investments

- Community Engagement

- Innovation and Economic Development

- Diversity and Equity

- Join Sacramento Fire

- Innovation and Economic Development

- Transportation

- Responding to Homelessness

- Office of the City Manager

- District 5 - Caity Maple

- Office of the City Manager

- Safety and Crime Prevention Tips

- Youth Workforce Development

- Police Department

- Community Development Meetings and Hearings

- River District Specific Plan

- Diversity and Equity

- Older Adult Services

- Vision Zero: Transportation Safety

- About Access Leisure

- Access Leisure Sports

- Access Leisure Sports

- Cannabis Management

- Office of the City Auditor

- Office of the City Auditor

- Human Resources

- Financial Empowerment

- Home

- Innovation and Economic Development

- Police Community Programs

- Community Response

- Community Response

- Workforce Development

- Police Community Programs

- Community Response

- Community Response

- Office of the City Manager

- Planning

- Housing

- Housing Development Toolkit

- City and County Partnership

- Housing Development Toolkit

- Housing

- Housing

- City and County Partnership

- Code Compliance

- Housing

- Revenue Division

- Priority Projects/Investments

- Housing

- Long Range

- About YPCE

- Older Adult Services

- Recreation

- Older Adult Services

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Older Adult Services

- Housing

- Home

- District 5 - Caity Maple

- About the Office of the City Auditor

- Join Sacramento Fire

- Animal Care

- District 7 Resources

- District 1 - Lisa Kaplan

- Community Engagement

- Police Community Programs

- About YPCE

- Police Department

- Youth, Parks, & Community Enrichment

- Specialty Parks

- Aquatics Programs

- Funding and Grants for Arts and Culture

- District 7 Resources

- Youth, Parks, & Community Enrichment

- CCS Partners

- Join Sacramento Fire

- About YPCE

- Aquatics Programs

- Recreation

- Aquatics

- City Auditor Reports

- Youth, Parks, & Community Enrichment

- Police Community Programs

- Youth, Parks, & Community Enrichment

- Public Art Projects

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Police Community Programs

- Youth, Parks, & Community Enrichment

- Recreation

- Recreation

- Youth, Parks, & Community Enrichment

- Home

- Convention and Cultural Services

- Arts and Culture

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Home

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Convention and Cultural Services

- Parking

- Innovation and Grants

- Aquatics

- CCS Partners

- Convention and Cultural Services

- Community Engagement

- District 7 - Rick Jennings

- Request a Permit

- CCS Partners

- Fire Department

- About YPCE

- Recycling & Solid Waste

- River District Specific Plan

- Convention and Cultural Services

- CCS Partners

- Emergency Management

- CCS Partners

- Commercial Waste Services

- Home

- Sacramento for All: Housing Education Resource Center

- Sacramento for All: Housing Education Resource Center

- Convention and Cultural Services

- About the City Attorney's Office

- Specialty Parks

- Planning

- Public Art Projects

- About Sacramento Fire

- CCS Partners

- Public Works

- Police Department

- About Access Leisure

- Access Leisure Sports

- Access Leisure Sports

- Cannabis Management

- Office of the City Auditor

- Office of the City Auditor

- Human Resources

- Financial Empowerment

- Home

- Innovation and Economic Development

- Police Community Programs

- Human Resources

- Human Resources

- Human Resources

- Human Resources

- Home

- Human Resources

- Payroll Division

- Camp Sacramento

- HR Documents & Resources

- Human Resources

- Human Resources

- Home

- District 7 Resources

- Fire Department

- Leisure Enrichment

- Employee & Retiree Benefits

- Youth Workforce Development

- Sacramento START

- Police Services

- District 5 - Caity Maple

- About the Office of the City Auditor

- Join Sacramento Fire

- Animal Care

- District 7 Resources

- District 1 - Lisa Kaplan

- Community Engagement

- Police Community Programs

- About YPCE

- Police Department

- Funding and Grants for Arts and Culture

- Youth Workforce Development

- Innovation and Economic Development

- Transportation Projects

- Transportation Projects

- Transportation Projects

- Transportation Projects

- Current Transportation Efforts, Plans and Programs

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Home

- Utilities

- Information Technology

- Information Technology

- City Government

- Information Technology

- Information Technology

- Information Technology

- Information Technology

- Home

- Fire Operations

- Information Technology

- Information Technology

- Collection Calendar

- City Government

- Information Technology

- Infrastructure Finance Division

- Home

- Infrastructure Finance Division

- Finance

- Infrastructure Finance Division

- Infrastructure Finance Division

- Building Programs

- Utilities

- Utilities

- Office of the City Manager

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Home

- Safety Tips

- Construction Coordination

- Transportation

- Transportation

- Utilities

- Public Works

- Maintenance Services

- Public Works

- Police Community Programs

- Home

- Survey Services

- Maintenance Services

- Maintenance Services

- Maintenance Services

- Curbside Collection Services & Rates

- Tree Permits and Ordinances

- Public Works

- Transportation

- Transportation

- Engineering

- Transportation

- Transportation

- Park Planning & Development

- Parks

- Public Works

- Transportation Projects

- Parks

- Transportation Projects

- Transportation Projects

- Transportation Projects

- Utilities

- Utilities

- Utilities

- Stormwater Quality

- Utilities

- Utilities

- Utilities

- Stormwater Quality

- Home

- Community Development

- Community Development

- Code Compliance

- Code Compliance

- Community Development

- Code Compliance

- Code Compliance

- Community Development

- Fire Prevention

- Construction & Demolition Recycling

- Code Compliance

- Recycling & Solid Waste

- Code Compliance

- Franchise Waste Haulers

- Residential Permit Parking (RPP)

- Code Compliance

- Fire Prevention

- Contact CDD

- Building

- Fire Prevention

- Fire Prevention

- Commercial Waste Services

- Cannabis Management

- City Government

- Commercial Waste Services

- Recycling & Solid Waste

- Disabled Person Parking

- Fire Code Enforcement

- Police Transparency

- Commercial Waste Services

- Contact Parking Services

- Residential Permit Parking (RPP)

- Community Development

- Request a Permit

- Request a Permit

- Fire Prevention

- Contact CDD

- Public Records

- Code Compliance

- Cannabis Management

- Request a Permit

- Request a Permit

- Engineering

- Request a Permit

- Housing Development Incentives

- Arts and Culture

- Housing Development Incentives

- Public Works

- Public Works

- Building

- Youth, Parks, & Community Enrichment

- Locate & Grow in Sacramento

- Building

- Request a Permit

- Public Works

- Revenue Division

- Revenue Division

- Commercial Waste Services

- Building Programs

- Urban Forestry

- Planning

- Finance

- Accounting Division

- Home

- Accounting Division

- City Auditor Reports

- Payroll Division

- Curbside Collection Services & Rates

- Office of the City Manager

- Finance

- Budget Division

- Budget Division

- Home

- Access Leisure

- Climate and Sustainability Planning

- Pay Your Utility Bill

- Hart Senior Center

- Recycling & Solid Waste

- Discount Deals

- Water Conservation

- Youth, Parks, & Community Enrichment

- Aquatics

- Finance

- Utility User Tax

- Recreation

- Office of the City Treasurer

- Office of the City Treasurer

- Office of the City Treasurer

- Home

- Office of the City Treasurer

- Parking

- COVID-19 Relief & Recovery

- Innovation and Economic Development

- Innovation and Economic Development

- Business

- Community Engagement

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Office of the City Manager

- Business

- Business

- Innovation and Economic Development

- Innovation and Economic Development

- Business

- Innovation and Economic Development

- CORE

- Convention and Cultural Services

- Stormwater Quality

- Funding and Grants for Arts and Culture

- Funding and Grants for Arts and Culture

- Funding and Grants for Arts and Culture

- Economic Gardening

- Arts and Culture

- Forward Together Pilot Grant for North Sacramento

- Innovation and Grants

- Recycling & Solid Waste

- Innovation and Grants

- Innovation and Grants

- Youth, Parks, & Community Enrichment

- About OAC

- Engineering

- Infrastructure Finance Division

- Home

- Infrastructure Finance Division

- Finance

- Infrastructure Finance Division

- Infrastructure Finance Division

- Building Programs

- Office of the City Treasurer

- Office of the City Treasurer

- Home

- Office of the City Treasurer

- Building

- Cannabis Business Operating Permits

- Revenue Division

- Development Standards

- Recycling & Solid Waste

- Development Standards

- Emergency Medical Services

- Finance

- Community Engagement

- Marina

- Household Hazardous Waste

- Public Works

- Community Development

- Revenue Division

- Utilities

- City Government

- Finance

- Animal Care

- Home

- Development Standards

- Marina

- Revenue Division

- Permits for YPCE

- Revenue Division

- Infrastructure Finance Division

- Home

- Workforce Development

- List of City Manager's Office Projects and Programs

- About YPCE

- Revenue Division

- Budget Division

- Revenue Division

- Revenue Division

- Transportation

- Current Transportation Efforts, Plans and Programs

- Transportation Projects

- Climate Action Initiatives

- Housing

- Public Works

- Current Transportation Efforts, Plans and Programs

- Current Transportation Efforts, Plans and Programs

- Current Transportation Efforts, Plans and Programs

- Current Transportation Efforts, Plans and Programs

- Public Works

- Home

- Recreation

- Recreation

- Street Landscape Maintenance

- Climate Action and Sustainability

- Climate Action and Sustainability

- Public Works

- Climate Action and Sustainability

- Climate and Sustainability Planning

- Climate Action and Sustainability

- Planning

- Fleet Services

- Climate Action and Sustainability

- Procurement Services Division

- Business Waste Requirements

- Permit Services

- Utilities

- Climate Action and Sustainability

- Utilities

- Recreation

- About YPCE

- Public Works

- Youth, Parks, & Community Enrichment

- About YPCE

- Public Art Projects

- Commercial Waste Services

- Permits for YPCE

- About YPCE

- Home

- Current Transportation Efforts, Plans and Programs

- Recreation

- Access Leisure

- Recreation

- Recreation

- Recreation

- Specialty Parks

- Specialty Parks

- Permits for YPCE

- Recreation

- Youth, Parks, & Community Enrichment

- About YPCE

- Youth, Parks, & Community Enrichment

- Aquatics

- Recreation

- Home

- Park Planning & Development

- Parks

- Public Works

- Transportation Projects

- Parks

- Transportation Projects

- Transportation Projects

- Transportation Projects

- Urban Forestry

- Parks

- Public Works

- Parks

- Home

- Urban Forestry

- Urban Forestry

- Urban Forestry

- Climate Action Initiatives

- Maintenance Services

- Safety Tips

- Office of the City Manager

- Specialty Parks

- Community Response

- Community Response

- Home

- Office of the City Manager

- Contact Us

- Contact Us

- Crime and Safety

- Crime and Safety

- Crime and Safety

- Crime and Safety

- Crime and Safety

- Police Services

- Fire Prevention

- Crime and Safety

- Police Services

- Crime and Safety

- Pay Your Utility Bill

- Crime and Safety

- Office of the City Auditor

- City Auditor Reports

- Fire Prevention

- Office of the City Manager

- Fire Department

- Join Sacramento Fire

- Crime and Safety

- Join Sacramento Fire

- Emergency Management

- Fire Department

- Fire Department

- Fire Department

- Fire Department

- Home

- Fire Department

- Fire Department

- Fire Department

- Home

- Fire Department

- Fire Prevention

- Contact CDD

- Building

- Fire Prevention

- Fire Prevention

- Request a Permit

- Request a Permit

- Police Services

- Police Services

- Request a Permit

- Request a Permit

- Police Services

- Police Department

- Request a Permit

- Police Services

- Police Services

- Police Services

- Police Services

- Public Information Office

- Police Services

- Home

- Police Department

- Home

- Police Department

- Police Department

- Request a Permit

- Police Services

- Police Services

- Police Services

- Police Services

- Police Services

- Police Services

- Police Department

- Emergency Management

- Police Department

- Information Technology

- Flood Preparedness

- Fire Department

- District 1 - Lisa Kaplan

- Utilities

- Utilities

- Office of the City Manager

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Home

- Safety Tips

- Safety Tips

- Office of the City Manager

- Specialty Parks

- Transportation

- Current Transportation Efforts, Plans and Programs

- Transportation Projects

- Climate Action Initiatives

- Housing

- Public Works

- Current Transportation Efforts, Plans and Programs

- Current Transportation Efforts, Plans and Programs

- Current Transportation Efforts, Plans and Programs

- Current Transportation Efforts, Plans and Programs

- Public Works

- Home

- Current Transportation Efforts, Plans and Programs

- Transportation Technology

- Current Transportation Efforts, Plans and Programs

- Parking

- Fleet Services

- Climate Action Initiatives

- Current Transportation Efforts, Plans and Programs

- Police Services

- Marina

- Marina

- Public Works

- Housing

- Home

- Public Works

- Curbside Collection Services & Rates

- Sacramento Valley Station

- Current Transportation Efforts, Plans and Programs

- Transportation Projects

- Public Works

- Long Range

- Current Transportation Efforts, Plans and Programs

- Transportation

- Public Works

- Home

- Public Works

- File a Police Report

- Public Works

- Transportation

- Transportation

- Transportation

- Transportation

- Transportation

- Transportation

- Engineering

- Transportation

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Home

- Utilities

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Public Works

- Climate Action Initiatives

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Public Works

- Climate Action Initiatives

- Recycling & Solid Waste

- Utilities

- Utilities

- Utilities

- Stormwater Quality

- Utilities

- Utilities

- Utilities

- Stormwater Quality

- Home

- City Departments

-

-

Community Development

-

Community Response

-

Convention and Cultural Services

-

Finance

-

Fire Department

-

Human Resources

-

Information Technology

-

Mayor and Council

-

Office of Public Safety Accountability

-

Office of the City Attorney

-

Office of the City Auditor

-

Office of the City Clerk

-

Office of the City Manager

-

Office of the City Treasurer

-

Police Department

-

Public Works

-

Utilities

-

Youth, Parks, & Community Enrichment

-

- Browse by categories

-

-

hiking Activities

-

pets Animals & Pets

-

domain_add Building & Planning

-

store Business

-

account_tree City Administration

-

category City Assets & Data

-

explore City Regions

-

diversity_4 Community Support

-

theater_comedy Culture & History

-

business_center Employment

-

directions Infrastructure

-

gavel Law, Code & Compliance

-

payments Money

-

park Outdoors & Sustainability

-

local_police Safety

-

directions_car Transportation

-

delete_sweep Utility Services

-

Use the menus above to navigate by City Departments or Categories.

You can also use the Search function below to find specific content on our site.

- Convention and Cultural Services

- Arts and Culture

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Home

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Convention and Cultural Services

- Recreation

- Recreation

- Youth, Parks, & Community Enrichment

- Community Engagement

- Community Engagement

- About YPCE

- Hart Senior Center

- Recreation

- Youth Workforce Development

- Older Adult Services

- Youth, Parks, & Community Enrichment

- Long Range

- Youth, Parks, & Community Enrichment

- Recreation

- Recreation

- Recreation

- Home

- Youth, Parks, & Community Enrichment

- About YPCE

- About YPCE

- Older Adult Services

- Recreation

- Home

- Parking

- Innovation and Grants

- Aquatics

- CCS Partners

- Convention and Cultural Services

- Community Engagement

- District 7 - Rick Jennings

- Request a Permit

- CCS Partners

- Fire Department

- About YPCE

- Recycling & Solid Waste

- River District Specific Plan

- Convention and Cultural Services

- CCS Partners

- Emergency Management

- CCS Partners

- Commercial Waste Services

- Home

- Recreation

- Access Leisure

- Recreation

- Recreation

- Recreation

- Specialty Parks

- Specialty Parks

- Permits for YPCE

- Recreation

- Youth, Parks, & Community Enrichment

- About YPCE

- Youth, Parks, & Community Enrichment

- Aquatics

- Recreation

- Home

- Animal Care

- Animal Care

- Community Development

- Animal Care

- Animal Care

- Animal Care

- Animal Care

- Animal Care

- Specialty Parks

- Animal Care

- Animal Care

- Street Landscape Maintenance

- Accessory Dwelling Units

- City Government

- Community Development

- Building

- Contact CDD

- Building

- Building

- Building

- Building

- Business Waste Requirements

- Commercial Waste Services

- Maintenance Services

- Procurement Services Division

- Parks

- Utilities

- Public Works

- Engineering

- Fire Prevention

- Building

- Building

- Building

- Building

- Engineering

- Home

- Public Works

- Housing

- Engineering

- Housing

- Planning

- Fire Prevention

- Contact CDD

- Building

- Fire Prevention

- Fire Prevention

- Community Development

- Community Development

- Building Programs

- Community Development

- Transportation

- Locate & Grow in Sacramento

- Planning

- Planning

- Planning

- Climate Action Initiatives

- Planning

- Planning

- Parks

- Community Development

- Community Development

- Planning

- List of City Manager's Office Projects and Programs

- Public Works

- Planning

- Planning

- Public Works

- Transportation

- Planning

- Planning

- Engineering

- 102-Acre Site

- Community Development Meetings and Hearings

- Major Planning Projects

- Locate & Grow in Sacramento

- Major Planning Projects

- Planning

- City Government

- Innovation and Economic Development

- Innovation and Economic Development

- Code Compliance

- Revenue Division

- Office of the City Manager

- Recycling & Solid Waste

- Business

- Business

- Procurement Services Division

- Revenue Division

- Business

- Revenue Division

- Major Planning Projects

- City Auditor Reports

- City Auditor Reports

- Cannabis Management

- Cannabis Management

- Cannabis Management

- Business Operations Tax

- Cannabis Management

- Office of the City Manager

- Cannabis Management

- City Auditor Reports

- Cannabis Management

- Major Planning Projects

- Parking

- COVID-19 Relief & Recovery

- Innovation and Economic Development

- Innovation and Economic Development

- Business

- Community Engagement

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Office of the City Manager

- Business

- Business

- Innovation and Economic Development

- Innovation and Economic Development

- Business

- Innovation and Economic Development

- Office of the City Manager

- Business

- Finance

- Accounting Division

- Police Services

- Procurement Services Division

- City Government

- Code Compliance Programs

- Code Compliance Programs

- Commercial Waste Services

- Procurement Services Division

- Procurement Services Division

- Home

- Commercial Waste Services

- Procurement Services Division

- Finance

- Finance

- Procurement Services Division

- Procurement Services Division

- Office of the City Auditor

- Police Transparency

- Office of the City Auditor

- Office of the City Auditor

- Accounting Division

- Office of the City Clerk

- Home

- About YPCE

- Arts and Culture

- Diversity and Equity

- Records Management

- Office of the City Auditor

- Director Hearings

- Director Hearings

- Director Hearings

- Director Hearings

- District 1 - Lisa Kaplan

- District 2 - Roger Dickinson

- City Auditor Reports

- Office of the City Clerk

- About YPCE

- Police Transparency

- Home

- Records Management

- Office of the City Manager

- Office of the City Manager

- Neighborhood Directory

- Neighborhood Directory

- Community Engagement

- Office of the City Clerk

- Office of the City Manager

- Innovation and Grants

- Office of the City Manager

- Office of the City Manager

- Office of the City Manager

- Home

- River District Specific Plan

- City Government

- Engineering

- City Government

- Long Range

- City Government

- City Government

- City Government

- City Government

- Information Technology

- Camp Sacramento

- Parking

- About YPCE

- Finance

- Drinking Water Quality

- Utilities

- Office of Public Safety Accountability

- Pay Your Utility Bill

- Police Services

- Police Services

- Marina

- Police Services

- Contact Us

- Police Services

- Office of the City Clerk

- Home

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Office of the City Clerk

- Mayor and Council

- Home

- Diversity and Equity

- Office of the City Auditor

- Office of Public Safety Accountability

- About the City Attorney's Office

- Office of the City Auditor

- Office of the City Auditor

- Police Department

- Maps and Geographic Information Systems

- Office of Public Safety Accountability

- Police Department

- City Government

- Office of the City Auditor

- Sacramento for All: Housing Education Resource Center

- 102-Acre Site

- 102-Acre Site

- 102-Acre Site

- Public Works

- Construction & Demolition Recycling

- About SPD

- Facilities & Real Property Management

- Public Works

- Adult Sports Activities and Resources

- Climate Action Initiatives

- Fleet Services

- Public Works

- Director Hearings

- Director Hearings

- Director Hearings

- Director Hearings

- Director Hearings

- Director Hearings

- General Plans

- Police Transparency

- Convention and Cultural Services

- Legislative Management

- District 1 - Lisa Kaplan

- Home

- Maps and Geographic Information Systems

- Office of the City Clerk

- Police Services

- Office of the City Auditor

- Office of Public Safety Accountability

- About the City Attorney's Office

- Office of the City Auditor

- Office of the City Auditor

- Police Department

- Maps and Geographic Information Systems

- Office of Public Safety Accountability

- Police Department

- City Government

- Office of the City Auditor

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Mayor and Council

- Maps and Geographic Information Systems

- City Elections

- Community Resources and Financial Empowerment

- Long Range

- Community Engagement

- Youth Workforce Development

- Locate & Grow in Sacramento

- Major Planning Projects

- Public Art Projects

- Engineering

- 102-Acre Site

- Community Development Meetings and Hearings

- Major Planning Projects

- Locate & Grow in Sacramento

- Major Planning Projects

- Planning

- Youth, Parks, & Community Enrichment

- Specialty Parks

- Long Range

- City Government

- List of City Manager's Office Projects and Programs

- Parking

- Transportation Projects

- About YPCE

- Home

- Engineering Programs & Services

- About OAC

- Youth, Parks, & Community Enrichment

- Maintenance Services

- City Government

- Older Adult Services

- Housing

- Home

- Youth, Parks, & Community Enrichment

- About YPCE

- About YPCE

- Older Adult Services

- Recreation

- Home

- 102-Acre Site

- Sacramento for All: Housing Education Resource Center

- Long Range

- City Auditor Reports

- Priority Projects/Investments

- Community Engagement

- Innovation and Economic Development

- Diversity and Equity

- Join Sacramento Fire

- Innovation and Economic Development

- Transportation

- Responding to Homelessness

- Office of the City Manager

- District 5 - Caity Maple

- Office of the City Manager

- Safety and Crime Prevention Tips

- Youth Workforce Development

- Police Department

- Community Development Meetings and Hearings

- River District Specific Plan

- Diversity and Equity

- Older Adult Services

- Vision Zero: Transportation Safety

- About Access Leisure

- Access Leisure Sports

- Access Leisure Sports

- Cannabis Management

- Office of the City Auditor

- Office of the City Auditor

- Human Resources

- Financial Empowerment

- Home

- Innovation and Economic Development

- Police Community Programs

- Community Response

- Community Response

- Workforce Development

- Police Community Programs

- Community Response

- Community Response

- Office of the City Manager

- Planning

- Housing

- Housing Development Toolkit

- City and County Partnership

- Housing Development Toolkit

- Housing

- Housing

- City and County Partnership

- Code Compliance

- Housing

- Revenue Division

- Priority Projects/Investments

- Housing

- Long Range

- About YPCE

- Older Adult Services

- Recreation

- Older Adult Services

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Older Adult Services

- Housing

- Home

- District 5 - Caity Maple

- About the Office of the City Auditor

- Join Sacramento Fire

- Animal Care

- District 7 Resources

- District 1 - Lisa Kaplan

- Community Engagement

- Police Community Programs

- About YPCE

- Police Department

- Youth, Parks, & Community Enrichment

- Specialty Parks

- Aquatics Programs

- Funding and Grants for Arts and Culture

- District 7 Resources

- Youth, Parks, & Community Enrichment

- CCS Partners

- Join Sacramento Fire

- About YPCE

- Aquatics Programs

- Recreation

- Aquatics

- City Auditor Reports

- Youth, Parks, & Community Enrichment

- Police Community Programs

- Youth, Parks, & Community Enrichment

- Public Art Projects

- Youth, Parks, & Community Enrichment

- Youth, Parks, & Community Enrichment

- Police Community Programs

- Youth, Parks, & Community Enrichment

- Recreation

- Recreation

- Youth, Parks, & Community Enrichment

- Home

- Convention and Cultural Services

- Arts and Culture

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Convention and Cultural Services

- Home

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Arts and Culture

- Convention and Cultural Services

- Parking

- Innovation and Grants

- Aquatics

- CCS Partners

- Convention and Cultural Services

- Community Engagement

- District 7 - Rick Jennings

- Request a Permit

- CCS Partners

- Fire Department

- About YPCE

- Recycling & Solid Waste

- River District Specific Plan

- Convention and Cultural Services

- CCS Partners

- Emergency Management

- CCS Partners

- Commercial Waste Services

- Home

- Sacramento for All: Housing Education Resource Center

- Sacramento for All: Housing Education Resource Center

- Convention and Cultural Services

- About the City Attorney's Office

- Specialty Parks

- Planning

- Public Art Projects

- About Sacramento Fire

- CCS Partners

- Public Works

- Police Department

- About Access Leisure

- Access Leisure Sports

- Access Leisure Sports

- Cannabis Management

- Office of the City Auditor

- Office of the City Auditor

- Human Resources

- Financial Empowerment

- Home

- Innovation and Economic Development

- Police Community Programs

- Human Resources

- Human Resources

- Human Resources

- Human Resources

- Home

- Human Resources

- Payroll Division

- Camp Sacramento

- HR Documents & Resources

- Human Resources

- Human Resources

- Home

- District 7 Resources

- Fire Department

- Leisure Enrichment

- Employee & Retiree Benefits

- Youth Workforce Development

- Sacramento START

- Police Services

- District 5 - Caity Maple

- About the Office of the City Auditor

- Join Sacramento Fire

- Animal Care

- District 7 Resources

- District 1 - Lisa Kaplan

- Community Engagement

- Police Community Programs

- About YPCE

- Police Department

- Funding and Grants for Arts and Culture

- Youth Workforce Development

- Innovation and Economic Development

- Transportation Projects

- Transportation Projects

- Transportation Projects

- Transportation Projects

- Current Transportation Efforts, Plans and Programs

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Home

- Utilities

- Information Technology

- Information Technology

- City Government

- Information Technology

- Information Technology

- Information Technology

- Information Technology

- Home

- Fire Operations

- Information Technology

- Information Technology

- Collection Calendar

- City Government

- Information Technology

- Infrastructure Finance Division

- Home

- Infrastructure Finance Division

- Finance

- Infrastructure Finance Division

- Infrastructure Finance Division

- Building Programs

- Utilities

- Utilities

- Office of the City Manager

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Home

- Safety Tips

- Construction Coordination

- Transportation

- Transportation

- Utilities

- Public Works

- Maintenance Services

- Public Works

- Police Community Programs

- Home

- Survey Services

- Maintenance Services

- Maintenance Services

- Maintenance Services

- Curbside Collection Services & Rates

- Tree Permits and Ordinances

- Public Works

- Transportation

- Transportation

- Engineering

- Transportation

- Transportation

- Park Planning & Development

- Parks

- Public Works

- Transportation Projects

- Parks

- Transportation Projects

- Transportation Projects

- Transportation Projects

- Utilities

- Utilities

- Utilities

- Stormwater Quality

- Utilities

- Utilities

- Utilities

- Stormwater Quality

- Home

- Community Development

- Community Development

- Code Compliance

- Code Compliance

- Community Development

- Code Compliance

- Code Compliance

- Community Development

- Fire Prevention

- Construction & Demolition Recycling

- Code Compliance

- Recycling & Solid Waste

- Code Compliance

- Franchise Waste Haulers

- Residential Permit Parking (RPP)

- Code Compliance

- Fire Prevention

- Contact CDD

- Building

- Fire Prevention

- Fire Prevention

- Commercial Waste Services

- Cannabis Management

- City Government

- Commercial Waste Services

- Recycling & Solid Waste

- Disabled Person Parking

- Fire Code Enforcement

- Police Transparency

- Commercial Waste Services

- Contact Parking Services

- Residential Permit Parking (RPP)

- Community Development

- Request a Permit

- Request a Permit

- Fire Prevention

- Contact CDD

- Public Records

- Code Compliance

- Cannabis Management

- Request a Permit

- Request a Permit

- Engineering

- Request a Permit

- Housing Development Incentives

- Arts and Culture

- Housing Development Incentives

- Public Works

- Public Works

- Building

- Youth, Parks, & Community Enrichment

- Locate & Grow in Sacramento

- Building

- Request a Permit

- Public Works

- Revenue Division

- Revenue Division

- Commercial Waste Services

- Building Programs

- Urban Forestry

- Planning

- Finance

- Accounting Division

- Home

- Accounting Division

- City Auditor Reports

- Payroll Division

- Curbside Collection Services & Rates

- Office of the City Manager

- Finance

- Budget Division

- Budget Division

- Home

- Access Leisure

- Climate and Sustainability Planning

- Pay Your Utility Bill

- Hart Senior Center

- Recycling & Solid Waste

- Discount Deals

- Water Conservation

- Youth, Parks, & Community Enrichment

- Aquatics

- Finance

- Utility User Tax

- Recreation

- Office of the City Treasurer

- Office of the City Treasurer

- Office of the City Treasurer

- Home

- Office of the City Treasurer

- Parking

- COVID-19 Relief & Recovery

- Innovation and Economic Development

- Innovation and Economic Development

- Business

- Community Engagement

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Innovation and Economic Development

- Office of the City Manager

- Business

- Business

- Innovation and Economic Development

- Innovation and Economic Development

- Business

- Innovation and Economic Development

- CORE

- Convention and Cultural Services

- Stormwater Quality

- Funding and Grants for Arts and Culture

- Funding and Grants for Arts and Culture

- Funding and Grants for Arts and Culture

- Economic Gardening

- Arts and Culture

- Forward Together Pilot Grant for North Sacramento

- Innovation and Grants

- Recycling & Solid Waste

- Innovation and Grants

- Innovation and Grants

- Youth, Parks, & Community Enrichment

- About OAC

- Engineering

- Infrastructure Finance Division

- Home

- Infrastructure Finance Division

- Finance

- Infrastructure Finance Division

- Infrastructure Finance Division

- Building Programs

- Office of the City Treasurer

- Office of the City Treasurer

- Home

- Office of the City Treasurer

- Building

- Cannabis Business Operating Permits

- Revenue Division

- Development Standards

- Recycling & Solid Waste

- Development Standards

- Emergency Medical Services

- Finance

- Community Engagement

- Marina

- Household Hazardous Waste

- Public Works

- Community Development

- Revenue Division

- Utilities

- City Government

- Finance

- Animal Care

- Home

- Development Standards

- Marina

- Revenue Division

- Permits for YPCE

- Revenue Division

- Infrastructure Finance Division

- Home

- Workforce Development

- List of City Manager's Office Projects and Programs

- About YPCE

- Revenue Division

- Budget Division

- Revenue Division

- Revenue Division

- Transportation

- Current Transportation Efforts, Plans and Programs

- Transportation Projects

- Climate Action Initiatives

- Housing

- Public Works

- Current Transportation Efforts, Plans and Programs

- Current Transportation Efforts, Plans and Programs

- Current Transportation Efforts, Plans and Programs

- Current Transportation Efforts, Plans and Programs

- Public Works

- Home

- Recreation

- Recreation

- Street Landscape Maintenance

- Climate Action and Sustainability

- Climate Action and Sustainability

- Public Works

- Climate Action and Sustainability

- Climate and Sustainability Planning

- Climate Action and Sustainability

- Planning

- Fleet Services

- Climate Action and Sustainability

- Procurement Services Division

- Business Waste Requirements

- Permit Services

- Utilities

- Climate Action and Sustainability

- Utilities

- Recreation

- About YPCE

- Public Works

- Youth, Parks, & Community Enrichment

- About YPCE

- Public Art Projects

- Commercial Waste Services

- Permits for YPCE

- About YPCE

- Home

- Current Transportation Efforts, Plans and Programs

- Recreation

- Access Leisure

- Recreation

- Recreation

- Recreation

- Specialty Parks

- Specialty Parks

- Permits for YPCE

- Recreation

- Youth, Parks, & Community Enrichment

- About YPCE

- Youth, Parks, & Community Enrichment

- Aquatics

- Recreation

- Home

- Park Planning & Development

- Parks

- Public Works

- Transportation Projects

- Parks

- Transportation Projects

- Transportation Projects

- Transportation Projects

- Urban Forestry

- Parks

- Public Works

- Parks

- Home

- Urban Forestry

- Urban Forestry

- Urban Forestry

- Climate Action Initiatives

- Maintenance Services

- Safety Tips

- Office of the City Manager

- Specialty Parks

- Community Response

- Community Response

- Home

- Office of the City Manager

- Contact Us

- Contact Us

- Crime and Safety

- Crime and Safety

- Crime and Safety

- Crime and Safety

- Crime and Safety

- Police Services

- Fire Prevention

- Crime and Safety

- Police Services

- Crime and Safety

- Pay Your Utility Bill

- Crime and Safety

- Office of the City Auditor

- City Auditor Reports

- Fire Prevention

- Office of the City Manager

- Fire Department

- Join Sacramento Fire

- Crime and Safety

- Join Sacramento Fire

- Emergency Management

- Fire Department

- Fire Department

- Fire Department

- Fire Department

- Home

- Fire Department

- Fire Department

- Fire Department

- Home

- Fire Department

- Fire Prevention

- Contact CDD

- Building

- Fire Prevention

- Fire Prevention

- Request a Permit

- Request a Permit

- Police Services

- Police Services

- Request a Permit

- Request a Permit

- Police Services

- Police Department

- Request a Permit

- Police Services

- Police Services

- Police Services

- Police Services

- Public Information Office

- Police Services

- Home

- Police Department

- Home

- Police Department

- Police Department

- Request a Permit

- Police Services

- Police Services

- Police Services

- Police Services

- Police Services

- Police Services

- Police Department

- Emergency Management

- Police Department

- Information Technology

- Flood Preparedness

- Fire Department

- District 1 - Lisa Kaplan

- Utilities

- Utilities

- Office of the City Manager

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Home

- Safety Tips

- Safety Tips

- Office of the City Manager

- Specialty Parks

- Transportation

- Current Transportation Efforts, Plans and Programs

- Transportation Projects

- Climate Action Initiatives

- Housing

- Public Works

- Current Transportation Efforts, Plans and Programs

- Current Transportation Efforts, Plans and Programs

- Current Transportation Efforts, Plans and Programs

- Current Transportation Efforts, Plans and Programs

- Public Works

- Home

- Current Transportation Efforts, Plans and Programs

- Transportation Technology

- Current Transportation Efforts, Plans and Programs

- Parking

- Fleet Services

- Climate Action Initiatives

- Current Transportation Efforts, Plans and Programs

- Police Services

- Marina

- Marina

- Public Works

- Housing

- Home

- Public Works

- Curbside Collection Services & Rates

- Sacramento Valley Station

- Current Transportation Efforts, Plans and Programs

- Transportation Projects

- Public Works

- Long Range

- Current Transportation Efforts, Plans and Programs

- Transportation

- Public Works

- Home

- Public Works

- File a Police Report

- Public Works

- Transportation

- Transportation

- Transportation

- Transportation

- Transportation

- Transportation

- Engineering

- Transportation

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Utilities

- Home

- Utilities

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Public Works

- Climate Action Initiatives

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Recycling & Solid Waste

- Public Works

- Climate Action Initiatives

- Recycling & Solid Waste

- Utilities

- Utilities

- Utilities

- Stormwater Quality

- Utilities

- Utilities

- Utilities

- Stormwater Quality

- Home

Search for content

- Home

- ...

- Housing

- Sacramento for All: Housing Education Resource Center

- 4. Market-Rate and Affordable Housing Development

SITE NAVIGATION

4. Market-Rate and Affordable Housing Development

Understanding the difference between market-rate housing and affordable housing is critical in comprehending the dynamics of housing production and the City’s housing goals. These differences shed light on the interplay between economic forces, policy, and social needs.

Market Rate Housing

Housing that is considered ‘market rate’ refers to residential properties that are priced according to current market conditions, without any subsidies or restriction on pricing. The cost for this type of housing is determined by how much people are willing to pay for housing in a specific location at a given time. Market-rate housing is priced according to market demand and can often be out of reach for many individuals.

Affordable Housing

Affordable housing aims to provide a variety of housing options for individuals and families who might otherwise struggle to afford market-rate housing. Affordable housing is designed to be affordable for people with low to moderate incomes and it may involve some form of subsidy or assistance to keep rents or purchase prices below market rates.

open_in_full

open_in_full

There are two main types of affordable housing:

- One type refers to regulated or deed restricted housing, meaning rents or sales prices are legally restricted to be affordable to lower-income residents. This housing is income or rent-restricted to ensure the housing is occupied by households earning a certain income, and rents are set to be affordable to those income levels.

- The other type is attainable housing or “naturally occurring affordable housing”. Examples of this include older housing stock, or housing that is lower-cost by design like micro-units, manufactured housing, accessory dwelling units, etc. Although more affordable than market-rate housing, this housing type is still unafforable to the lowest-income residents.

How does housing get developed?

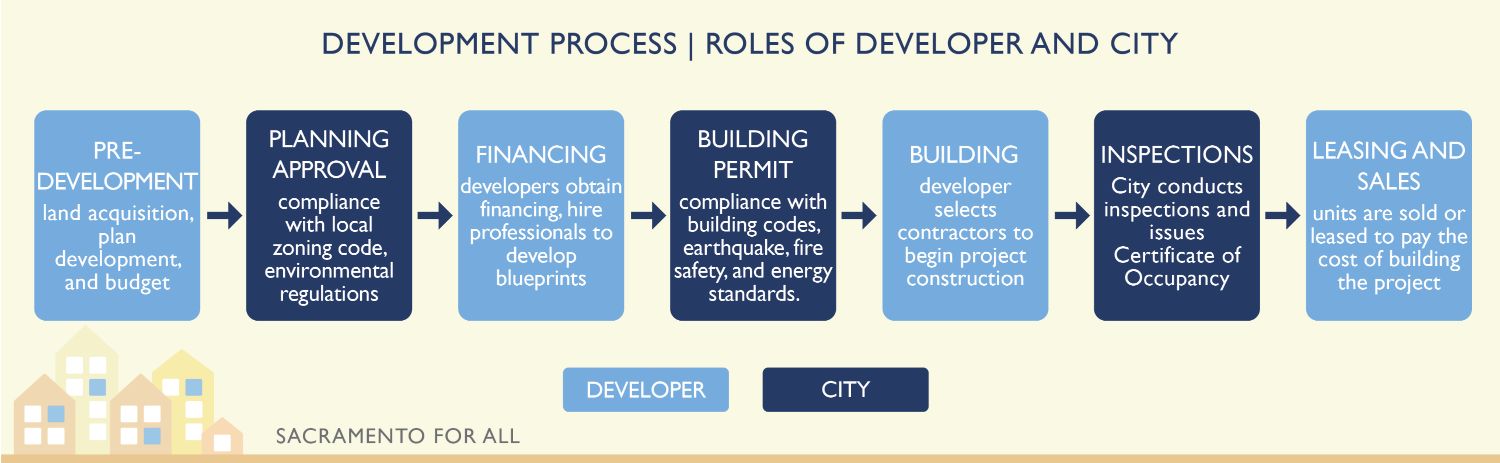

Developers go through many steps to develop housing, which requires coordination with many entities including the City, lenders, architects, contractors, and more. The diagram below depicts the steps a developer must take to ensure a project is completed, while also meeting the City’s planning and building regulations.

open_in_full

open_in_full

Determining the financial feasibility of a housing project is a crucial first step of this lengthy process. Moreover, in the last two decades the cost to build housing has significantly increased. Between 2000 and 2016, the cost of building a 100-unit affordable project in California increased by sixty percent according to a study by the Terner Center for Housing Innovation. This study found that affordable housing is impacted by the same trends that increase costs for market-rate housing, in addition to being subject to increased local scrutiny, further inflating costs.

There are three categories of costs that affect the feasibility of building new housing. These include:

Acquisition: The cost of the land and closing costs.

Soft Cost: This refers to legal and professional fees (architecture, etc.), insurance, financing, and development fees.

Hard Cost: This refers to the cost of materials and labor for construction. This cost has the biggest impact on the financial feasibility of a project.

open_in_full

open_in_full

These categories give a developer an accurate cost estimate to pursue financing to pay for the cost of building a project. Generally, developers will obtain funding in the form of a loan from a bank, and equity from an investor. These forms of financing require certain returns on investements (interest) before lenders or investors are willing to proceed with the financing. Developers are responsible for fully repaying the banks and investors including the agreed upon interest. For market-rate housing, this is all the funding they need to move forward with their project.

Affordable housing projects collect less in rents than market-rate housing, creating a gap in funding for the developer that must be filled through public subsidies. Subsidies generally come from local, state, or federal governments, and can be used to cover construction costs, rents, or operating costs. Affordable housing developers generally pursue multiple subsidies to help fill the financing gap needed to make a project feasible.

Unfortunately, due to current market dynamics and development requirements, hard costs and interest rates have increased significantly since 2019 (12.9 and 8.5 percent respectively). These higher costs have created an environment where the development of many housing projects has become financially infeasible.

For more information on the financial feasibility of building housing, visit the Terner Center’s Interactive Web Application Demystifying Development Math.

Additional Resources

Please see below for additional resources:

- Housing Element | City of Sacramento

- Housing Development Toolkit | City of Sacramento

- What is Affordable Housing? | Local Housing Solutions

- Financing Multifamily Housing 101 | Local Housing Solutions

- How is Affordable Housing Funded? | Local Housing Solutions

- Demystifying Development Math: Interactive Resource | Terner Center for Housing Innovation

- Making It Pencil: The Math Behind Housing Development | Terner Center for Housing Innovation

- The Cost of Building Housing Series | Terner Center for Housing Innovation

ON THIS PAGE